Honolulu, HI – The number of Japanese visitors in Hawaii hasn’t returned to pre-pandemic levels, which is weighing heavily on the state’s economy. While the yen’s recent rebound eased the burden of traveling for the Japanese tourists, three years of Covid restrictions in Japan – even after they’ve been lifted – seem to overshadow this effect.

In Hawaii – a state which reaps its largest revenue from the hospitality industry – Japan has long been the second-largest tourist market, after the United States. Due to Hawaii’s geographical proximity to Japan and the Japanese people’s long-held affection for the islands, Japanese travelers accounted for 15.4% of total visitors in Hawaii and spent as much as $2.3 billion in 2019, according to data from Hawaii’s Department of Business, Economic Development and Tourism (DBEDT).

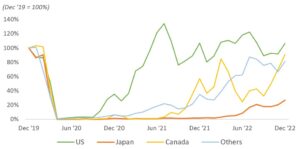

The share of Japanese tourists has plummeted since its government imposed sweeping travel restrictions upon the outbreak of Covid. In December 2022, total arrivals to the islands recovered to 91.5% of the pre-pandemic level. However, Japanese tourists only accounted for 4.3% of total visitors, pushed down to third place by Canadians, who now made up 6.8% of the share.

Japanese tourists are the slowest to recover from the pre-pandemic level

Data: Hawaii’s Department of Business, Economic Development and Tourism (DBEDT)

Although Hawaii’s stringent travel measures were lifted last October, the yen slumped to a 24-year low against the dollar in the same month, rendering a trip to Hawaii an even more costly event for the Japanese.

The prospects don’t look bright for Hawaii unless this large international tourist group makes a sufficient comeback to the islands, and here’s why.

Tourism businesses catering to the Japanese took a hit

While Hawaii’s hotel revenues grew by 22.7% in 2022 compared to the pre-pandemic 2019 – due to an increase in the total number of visitors – other industry peers felt the impact of the significant decrease in Japanese travelers.

“The hotel chains and everybody, they’re actually doing really well. It’s just that, like us, Japanese tour agencies, Japanese-specific agencies, we’re [all] really waiting for it to open back up,” said Jimmy Soga, a sales development specialist at the largest Japanese travel agency in Hawaii. His company solely caters to people coming from Japan.

According to Soga, around 12,000 Japanese tourists visited Hawaii each month before the pandemic. That number dropped down to 7,000 in 2022. As his travel agency served almost 1/3 of these people, it saw a significant drop in customers.

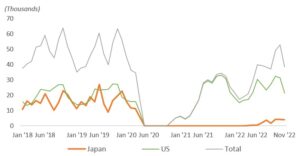

Another sector that took a big hit was the wedding business. In pre-pandemic years, Japanese tourists represented a large part – as much as 30 to 40% – of those visiting Hawaii for weddings or honeymoons (see graph). June bride is “a big thing in Japan,” said Soga.

Data: Hawaii Tourism Authority (HTA)

Now, it is mostly U.S. travelers who come to the Aloha State for weddings and honeymoons.

“There are hardly any Japanese customers yet. We’re still waiting on them to come back,” said Robert Hamilton, owner of Bridal Dream Hawaii, a wedding service business based in O’ahu – the island Japanese tourists visit the most.

“I used to shoot Japanese wedding photos, like, almost every day,” Hamilton said. “But now there’s no one, almost none.”

Labor market grapples with unemployment and lagging consumer demand

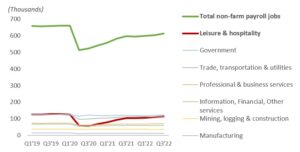

It is not surprising that leisure and hospitality is the most influential industry in Hawaii’s labor market; the total number of non-farm payroll jobs almost hinges on the number of jobs in that sector (see graph).

The number of total non-farm payroll jobs moves in sync with the number of leisure & hospitality jobs / Data: DBEDT, seasonally adjusted

Though Hawaii’s overall job growth appears to be back on track to reaching pre-pandemic levels, some tourism & recreation businesses to which Japanese customers used to be a significant contributor still lag behind normal, negatively impacting the statewide employment situation.

According to DBEDT, Hawaii’s unemployment rate is forecasted to be 3.5% in 2023, up from the state’s average unemployment rate of 2.5% from 2017 to 2019.

Soga feels the impact of this trend. “During the first part [of the pandemic], we have furloughed almost close to 80%,” he said. Of their nearly 200 staff members, only 60 to 80 are now back in the office.

Hamilton said that his wife, who used to work for the Japanese wedding dress shop, has been out of work for almost three years because there were not enough customers coming into the islands.

“Until Hawaii sees the same level of Japanese tourists as the past, there will be an over-abundance of tourism-related workers with not enough work,” he wrote in an email. “Our prices are already as low as possible. At this time, supply is greater than demand.”

Japanese tourists have been the biggest international spenders

Expenditure by Japanese tourists is important to the Hawaiian tourism industry. In 2019, their average per-person per-day spending was $242, easily topping Americans at $188 and Canadians at $165 (see graph).

Japanese visitors spend the most per day compared to two other major markets

Data: DBEDT/ Note: Annual 2020 visitor spending statistics were not available due to COVID-19 restrictions

Despite their trips usually being on the shorter side – the length of a stay in Hawaii averaged 5.9 days for Japanese, 11.9 days for Canadians, and 9 days for Americans in 2019 – Japanese visitors’ total spending still came in right behind that of the U.S. in the same year, eclipsing Canadians and accounting for 12.7% of total tourist spending in Hawaii.

A sharp decline in these big spenders may seem like a trivial loss to the islands, with tourists from the mainland spending as much as $16 billion last year – up 39% from 2019. In fact, U.S. tourists have driven up the total tourist expenditure even higher than the pre-pandemic level. However, it is uncertain whether the strong domestic demand for Hawaii will withstand a downturn in the U.S. economy.

Furthermore, the total increase in tourist spending, in part, stems from inflation. Travel prices in December 2022 were up 17% in lodging, 19% in food, 36% in car rentals and 13% in entertainment compared to the same month in 2019, according to the travel inflation report by NerdWallet.

The depreciated yen and strong dollar also could have dampened spending by the Japanese, narrowing the gap between theirs and the mainlanders’ daily personal spending.

The ways in which U.S. and Canadian tourists offset the drop in Japanese spending in Hawaii seem to work for the time being. But the return of big-spending Japanese is critical to the state’s revenue in the long run, as the current macroeconomic factors will inevitably change – a process that has already begun.

The problem is that the Japanese are reluctant to travel to Hawaii, or abroad, at all

Almost three years of tight controls on travel haven’t spurred any pent-up demand among the Japanese for a trip to their most desired outbound destination – if anything, it has led to a mass avoidance of overseas travel.

In a survey conducted by Morning Consult in August 2022, as many as 35% of all Japanese respondents said that they will “never travel again,” far exceeding other nations’ travel reluctance, which ranged from 4% to 15%.

Even though the yen has rallied in the previous months and the strength of the dollar continues to ebb, Japanese tourists reached a mere 27% of pre-pandemic levels last December.

Soga said his company hasn’t experienced a noticeable change despite the weakening of the dollar. “Because I think people in Japan are still fearing Covid,” he said.

Hiroyuki Takahashi, chairman of the Japan Association of Travel Agents, called the yen factor a “superficial” cause of the faltering return of Japanese people to Hawaii during a recent interview with Nikkei Asia.

“My understanding is that it is a question of Japanese people’s mindset; they have a continued fear of infections,” he said.

The islands call for more Japanese tourists to counter slowdown, experts say

Unless Japanese tourists reignite their passion for vacationing in Hawaii, the state faces a threat of economic slowdown as mild recession looms in the US economy, experts say.

If Japanese tourism in Hawaii does not reach at least 50% of pre-pandemic levels in the first quarter of 2023 and the US economy continues to slump, “Hawaii would probably be in a recession,” said Carl Bonham, the executive director of the University of Hawaii Economic Research Organization (UHERO) in a press conference last September.

Another study by the same organization in the following December predicted that “the ongoing recovery of international travel – particularly from Japan – will provide support for tourism” and help the state dodge recession.

With the Japanese comeback remaining below expectation even after the two biggest obstacles – travel restrictions and strong dollar – have been, or are on their way to being cleared, economic woes vex the Aloha State.

“Because the dollar is getting weaker and the yen [is] starting to pick up, [we’re] hoping by Spring, Summertime, it will start getting more and more normal,” said Soga.